7 Data-Driven Reasons Real Estate Powers Kenya’s GDP and Economic Growth

Introduction

The real estate sector in Kenya is far more than just bricks and mortar it is a vital economic engine that powers job creation, infrastructure development, and urbanization. Real estate Kenya GDP has increased over the past two decades, Kenya’s property market has transformed from a fragmented, informal space into a dynamic, investment-driven industry that plays a pivotal role in GDP growth and economic transformation.

Table of Contents

In this comprehensive analysis, we explore 7 data-driven reasons why real estate Kenya GDP performance is interlinked and how the sector impacts national development goals, employment, income distribution, and foreign direct investment (FDI). Whether you’re a policymaker, developer, diaspora investor, or student of economics, understanding the role of real estate in shaping Kenya’s economy is key.

1. Direct Contribution to GDP Growth

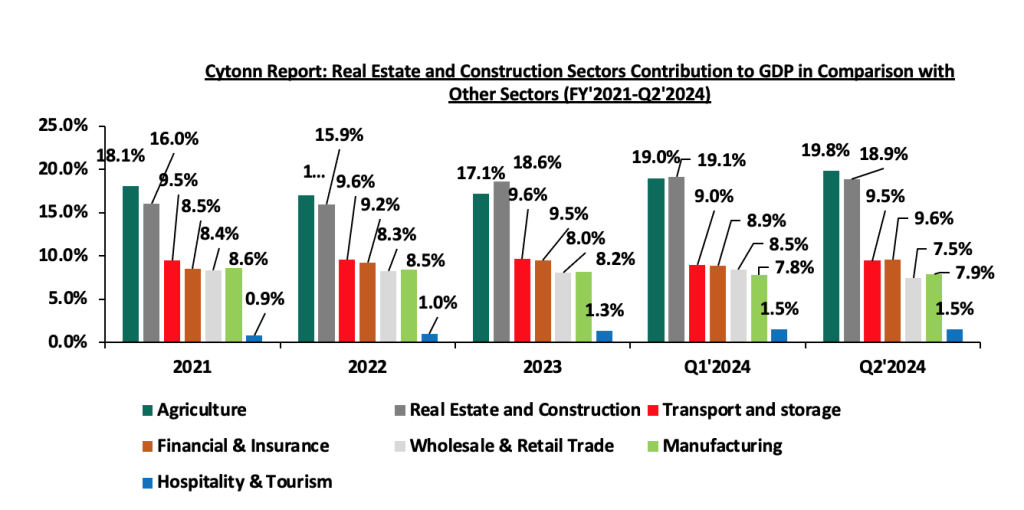

According to the Kenya National Bureau of Statistics (KNBS), real estate and construction combined contributed over 13.8% to Kenya’s GDP in 2023, making them among the top-performing sectors alongside agriculture, manufacturing, and services.

The real estate Kenya GDP linkage can be broken down as follows:

- Rental income from commercial and residential properties

- Sale of new housing units and property transfers

- Income generated by real estate agencies, brokers, and management firms

- Taxes, levies, and permit fees paid to county and national governments

In urban areas like Nairobi, Mombasa, and Kisumu, real estate activities account for up to 25% of local GDP, particularly in land-rich counties such as Kiambu and Machakos.

2. Real Estate as a Job Creation Machine

Kenya’s real estate and construction sectors are among the largest employers in the country, engaging both formal and informal labor. Key areas of job creation include:

- Construction labor (engineers, masons, carpenters, plumbers)

- Real estate sales and marketing professionals

- Architects, surveyors, and land economists

- Property management and security services

- Material supply chains and hardware distribution

According to the Federation of Kenya Employers (FKE), over 2.5 million jobs are directly or indirectly linked to the real estate industry.

Real estate is also a gateway to self-employment, especially among youth running small construction firms, interior design startups, or online property listing platforms.

Natural Internal Link: Discover how Gazebo Homes integrates job creation through construction and property management in this podcast

3. Driving Infrastructure Investment and Urbanization

Kenya’s urbanization rate currently stands at 4.3% per annum, one of the highest in Sub-Saharan Africa. This has led to:

- Expansion of road networks to support new estates

- Electricity and water grid extension to new residential zones

- Growth of commercial hubs and business parks in peri-urban areas

- Increased demand for schools, health centers, and shopping malls

Large-scale real estate developments spur infrastructure development, especially in satellite towns like Ruiru, Syokimau, and Kitengela.

The government also partners with private real estate firms in Public-Private Partnerships (PPPs) to fast-track affordable housing, sewerage systems, and smart cities.

Learn more about PPPs and infrastructure impact at the Kenya PPP Directorate

4. Catalyst for Local Industry Growth

Every real estate project creates a ripple effect across multiple industries. From cement manufacturers and steel suppliers to paint companies and furniture makers, property development stimulates demand across sectors.

Local industries that benefit include:

- Construction Materials: Bamburi Cement, East African Portland Cement, Devki Steel

- Transport: Moving companies, delivery trucks, matatu routes for new neighborhoods

- Retail: Supermarkets, mini-marts, and fuel stations open near housing estates

- Manufacturing: Kitchen fittings, tiles, glass, doors, and windows

This interdependence boosts manufacturing GDP and promotes value chain development.

5. Real Estate as a Foreign Direct Investment (FDI) Magnet

Kenya has attracted significant foreign investment into its real estate sector in the last 10 years. These investments come in the form of:

- Diaspora property purchases

- Joint ventures with foreign developers

- REITs (Real Estate Investment Trusts) and private equity funds

- Tourism and hospitality properties (resorts, serviced apartments)

The World Bank notes that FDI inflows into Kenyan real estate and infrastructure have surpassed USD 400 million annually in recent years.

Global investors are drawn to:

- Kenya’s position as an East African hub

- High rental yields in urban centers (6–9%)

- Growing middle-class demand for quality housing

Natural Internal Link: See how diaspora investors tap into Kenya’s booming market in this guide

6. Stimulating Financial Sector Growth and Mortgage Access

Real estate transactions form a major source of revenue for Kenya’s banking and financial services sector through:

- Mortgage lending

- Construction finance

- Property insurance

- Land transfer levies

- Home improvement loans

As of 2023, Kenya had over 28,000 active mortgage accounts totaling KES 254 billion, according to the Central Bank of Kenya (CBK). While this number is low compared to population size, it’s growing, thanks to:

- Government-backed KMRC (Kenya Mortgage Refinance Company)

- Employer housing schemes

- SACCOs and micro-lenders offering land purchase loans

Insert image here – Mortgage loan desk at a Kenyan bank

External Link (Dofollow): Explore CBK’s latest mortgage report at Central Bank of Kenya

7. Enhancing Government Revenue Collection

The Kenyan government earns significant income through the real estate sector by collecting:

- Stamp Duty (2–4% of property value)

- Capital Gains Tax (15% on net profit)

- Land Rates and Rent (annual levies from county governments)

- Building Permit Fees and approval charges

- NSSF/NHIF contributions from construction workers

Real estate therefore provides a stable, scalable source of tax revenue that funds public infrastructure and national development.

Counties like Nairobi, Kiambu, and Machakos rely heavily on land rates and permit fees for their annual budgets.

Real Estate and Kenya’s Vision 2030

Under the Vision 2030 economic blueprint, real estate is identified as a key enabler of:

- Affordable housing

- Urban modernization

- Investment attraction

- Employment and innovation

The Affordable Housing Programme (AHP) aims to deliver over 250,000 housing units annually, stimulating both supply and demand sides of the sector.

Mega projects like Konza Technopolis, Tatu City, and Nairobi Railway City are centered around integrated real estate development.

Learn more about real estate’s impact on urban planning in this article

Challenges Facing Kenya’s Real Estate Sector

Despite its importance, the real estate industry faces challenges that limit its full potential:

| Challenge | Impact |

|---|---|

| High construction costs | Limits affordable housing supply |

| Land ownership disputes | Slows down projects and deters investors |

| Regulatory bottlenecks | Delay permits and approvals |

| Limited access to credit | Reduces buyer and developer capacity |

| Infrastructure delays | Increases development risk |

Overcoming these obstacles requires coordinated action from government, private developers, and financial institutions.

Real Estate Trends Shaping Future Economic Growth

Looking forward, Kenya’s property market is expected to grow alongside:

- Green and smart buildings

- Co-living and student housing models

- REIT expansion for retail investors

- Mixed-use developments in tier-2 towns like Eldoret and Nyeri

- Digitization of property records (Ardhisasa)

These innovations will further strengthen the real estate Kenya GDP correlation and help meet housing demand sustainably.

Conclusion

From direct GDP contribution and job creation to infrastructure growth and foreign investment, real estate is a cornerstone of Kenya’s economic development. It shapes cities, creates wealth, and links multiple sectors into a powerful value chain.

As the country urbanizes and income levels rise, the property sector will only grow more integral to national progress. Stakeholders must collaborate to make real estate more affordable, sustainable, and transparent.

For investors, developers, and citizens alike Kenya’s real estate sector is not just a market. It’s a growth engine.

Frequently Asked Questions (FAQs)

1. How much does real estate contribute to Kenya’s GDP?

As of 2023, real estate and construction contribute over 13.8% of Kenya’s GDP, making them top economic drivers.

2. What sectors benefit the most from real estate development?

Construction, manufacturing, retail, finance, and transport sectors experience direct and indirect growth from property development.

3. Why is foreign investment increasing in Kenyan real estate?

High rental returns, urbanization, and strategic location make Kenya attractive for diaspora and global investors.

4. What challenges slow down real estate’s economic impact?

Land disputes, financing gaps, permit delays, and infrastructure challenges are key barriers.

5. How can real estate support job creation in Kenya?

It creates direct employment in construction and indirect roles in logistics, marketing, retail, and property management.