5 Proven Reasons Title Deed Security Matters in Kenya and How to Resolve Land Disputes

Introduction

In Kenya’s fast-growing real estate market, title deed security is more than a legal formality it’s your ultimate protection against fraud, ownership disputes, and financial loss. For homebuyers, developers, and diaspora investors, securing and verifying property titles is not optional. It’s a necessity.

The country’s complex history of informal land allocation, inconsistent documentation, and corruption has made land ownership a highly sensitive and often litigated issue. In fact, over 50% of civil cases in Kenyan courts are related to land disputes, according to the Judiciary of Kenya.

Table of Contents

This article explores the 5 proven reasons title deed security is critical, how to avoid fraudulent transactions, and practical steps for land dispute resolution in Kenya.

1. Title Deeds Legally Prove Ownership

A title deed is an official legal document that confirms the rightful owner of a piece of land. Without it, ownership can be contested even years after purchase. Many Kenyans have lost their life savings to fraudulent deals where fake or duplicate title deeds were issued.

What to look for in a valid title deed:

- The deed must be issued by the Ministry of Lands

- It should bear the official seal and registration number

- The property description and size should match land records

- The seller’s name must appear as the registered owner

Insert image here – Sample of an authentic Kenyan title deed

2. Avoiding Costly and Lengthy Land Disputes

Land disputes in Kenya can take years to resolve, draining resources and sometimes resulting in the complete loss of property. Causes of these disputes include:

- Double allocation of land

- Inheritance and succession issues

- Forged or lost documents

- Unauthorized sales by family members or land cartels

Natural Internal Link: Learn how Gazebo Homes helps clients avoid these risks through proper due diligence in this article

Insert image here – A courtroom with ongoing land case proceedings

3. Title Deed Security Enables Access to Financing

Most Kenyan banks and microfinance institutions will only accept titled land as collateral. If your land is not formally registered or if the title is disputed, you cannot secure a mortgage, construction loan, or business credit.

This becomes especially important for:

- Developers seeking capital

- Families building on ancestral land

- Diaspora investors managing property remotely

A secure title deed unlocks wealth and financial leverage without it, your land is just space.

See how land title deeds affect credit access in Africa via World Bank Report on Property Rights

Insert image here – Bank officer reviewing a property title as loan security

4. Verified Titles Reduce the Risk of Buying Stolen or Public Land

Buying land in Kenya without conducting thorough due diligence is risky. Some parcels are part of public land, riparian reserves, or roads earmarked for expansion. Other properties are sold using fake titles created by syndicates.

To avoid this:

- Conduct a land search at the Ministry of Lands (Ardhi House or online via eCitizen)

- Obtain a certified copy of the title

- Engage a licensed surveyor to confirm boundaries

- Verify the land history from local land control boards and the community

Insert image here – A land search printout from the eCitizen platform

Tip: A search costs just KES 500 but can save you millions in losses.

5. Legal Transfers Protect Buyers and Sellers

Property transfers in Kenya must be conducted legally to prevent future ownership challenges. This includes:

- Sale agreement signed by both parties and witnessed

- Land control board (LCB) consent

- Payment of stamp duty (usually 2–4% of the property value)

- Formal transfer of ownership at the land registry

Any missing step invalidates the transaction, which may expose the buyer to litigation.

Natural Internal Link: Looking to buy a home safely? Read our step-by-step guide on how to buy property in Kenya

Insert image here – Buyer and seller signing land sale agreement with lawyer present

Common Land Disputes in Kenya and Their Causes

| Dispute Type | Common Cause |

|---|---|

| Double sale | Unscrupulous sellers or lack of verification |

| Family inheritance conflict | Lack of will or succession planning |

| Boundary disputes | Poor surveying or encroachment |

| Ownership of public land | Lack of awareness or fraud |

| Forged title deeds | Use of fake documents or corrupt registries |

Insert image here – Table showing causes of land disputes

How to Verify a Title Deed in Kenya

Step-by-step land search process:

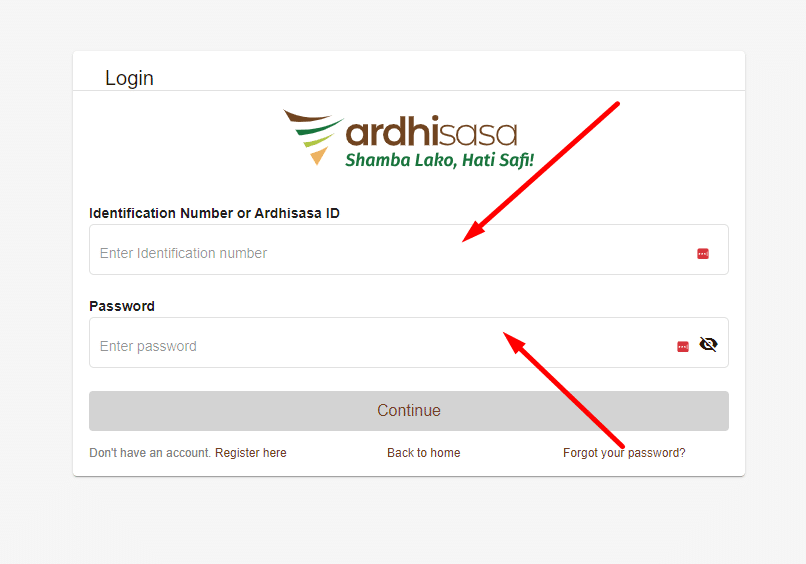

- Visit eCitizen platform or Ardhi House (Ministry of Lands)

- Provide the title number and land parcel details

- Pay the land search fee (KES 500)

- Receive official search results showing current ownership, encumbrances, or caveats

Optional verification steps:

- Conduct a historical search for past ownership

- Request mutation forms from the survey office

- Involve a property lawyer to review authenticity

Insert image here – Screenshot of eCitizen land search interface

Legal Avenues for Land Dispute Resolution in Kenya

If you’re involved in a land dispute, these are your main options for resolution:

1. Mediation and Arbitration

- Ideal for family or inheritance disputes

- Saves time and court costs

- Common in rural communities and Islamic succession cases

2. Land and Environment Court (ELC)

- Handles formal disputes involving fraud, encroachment, and illegal occupation

- Must file petition with supporting documents

3. Alternative Dispute Resolution (ADR)

- Encouraged by the Judiciary to reduce case backlog

- Involves village elders, religious leaders, or registered mediators

4. Land Control Board (LCB) Hearings

- If buyer or seller fails to secure consent, LCBs can review the case

Insert image here – A land tribunal or public LCB meeting in session

The Role of Technology in Title Deed Security

Kenya has made progress digitizing land records through the Ardhisasa platform, starting with Nairobi County. Benefits include:

- Faster land searches

- Reduced human interference

- Easier transfer tracking

- Improved title traceability

The Ministry of Lands plans to scale this nationwide to eliminate manual records and curb fraud.

Learn more at Ardhisasa – Ministry of Lands

Why Diaspora Investors Must Prioritize Title Verification

Diaspora buyers are prime targets for fraudsters due to their physical absence. Many fall victim to:

- Fake brokers

- Unscrupulous relatives

- Bogus developers with no registered titles

To mitigate this risk, work with verified property agents or developers with a solid track record and legal support services.

Natural Internal Link: See how Gazebo Homes protects diaspora clients from fraud in this case study

Conclusion

In Kenya, title deed security is your first line of defense in land ownership. It protects your property rights, prevents costly disputes, enables financing, and secures your legacy. With more digitization and public awareness, buyers now have better tools to verify land and transact safely.

Whether you’re buying your first plot or expanding your investment portfolio, never compromise on due diligence. Work with licensed professionals, use verified platforms, and make sure your title deed is as secure as your property itself.

Frequently Asked Questions (FAQ)

How do I know if a title deed is genuine in Kenya?

Conduct a land search at the Ministry of Lands or through eCitizen. You can also consult a licensed advocate or surveyor.

Can land have more than one title deed?

Yes, but only one is valid. Others may be forgeries or issued erroneously. Always verify with the land registry.

How much does it cost to transfer land ownership?

Stamp duty (2–4%), legal fees, consent charges, and transfer fees—budget approximately 6–8% of the land’s value.

What do I do if someone else claims to own my land?

Seek legal help immediately, file a caveat at the land registry, and gather all supporting documents.

Is it safe to buy land in Kenya while abroad?

Yes, if you work with a trusted developer like Gazebo Homes and verify all documents before making payments.